I would like to start this market commentary off by thanking all of our clients for their support and trust in us. I got into this business because of a series of unfortunate events that occurred when my family trusted a professional adviser and bank. I saw my grandfather’s estate cut in half during the 2000-2002 bear market. I truly believed that there was a better way, and I was going to find it. We have spent the better part of the past two decades working to do just that. A lot of so-called professional advisers tout their abilities and smarts, whether they work for big famous firms, or have the latest mousetrap, but at the end of the day the proof is in the pudding. Everyone is a genius when markets are going up. The true test of an adviser’s worth is when things get tough – like really tough. At Cabana, we built everything we do with this in mind. So first and foremost, I want to say how much I appreciate you being our partner in this greatest of endeavors called investing. Now let’s talk numbers and the state of the current market.

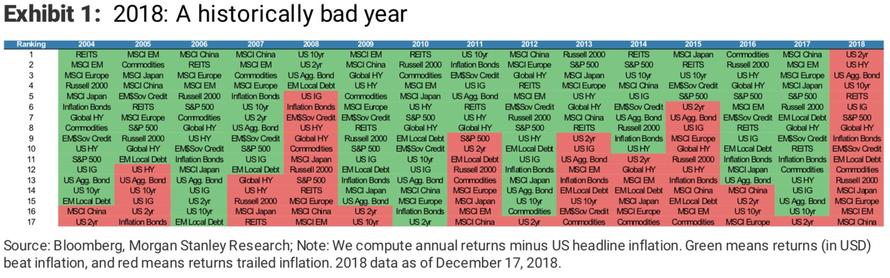

According to Deutsche Bank, 2018 officially has been the worst year for investors of all types and across all investments since 1901, when such records started being kept. You read that correctly – this year has been worse than 2008, worse than 2002, and worse the Great Depression. Below is a Bloomberg and Morgan Stanley chart of asset class performance over the past 15 years (Exhibit 1), which provides a good visual depiction of what I am talking about. As you can see, EVERYTHING is in the red. The investments at the bottom did the worst and the ones at the top did the best (relatively speaking). I have commented on this over the past few weeks and things have just gotten worse – a lot worse! As of market close on Christmas Eve, the U.S. stock market was down 21% since October 1. It was down 16% in December and 10% in the past week alone. Huge widely held stocks like Apple, Google and Facebook are down 37%, 24% and 43% from highs made in the second half of this year. This now qualifies as tough – really tough.

On August 20, I pointed out that the U.S stock market was the only market in the world that was holding up and the divergence between the U.S. equity market and other asset classes was the greatest in fourteen years. I worried that we had “a lot of weight pulling in the opposite direction.” Something had to change. Either other asset classes had to catch up or the U.S. market would fall. Unfortunately, it was the latter, but it was no surprise to us and we were prepared. As of this writing we have reallocated all of our portfolios twice since then (once in early October and again last week). We do this so that we are continually working to take risk off the table as investment conditions deteriorate. The more conservative the portfolio, the quicker risk is removed during reallocations. We want to always stay invested, but rotate into those investments that perform relatively well in a bad environment. Even if no asset is making money, we always want to be in the things that are losing the least. Our ultimate objective is to keep our portfolios within their target drawdown number. This number ranges from 5% in our most conservative portfolio to 20% in our most aggressive portfolio. The number represents in percentage terms how much each portfolio can be expected to drop when things get tough, like really tough, like 2018 tough. We compute the change within each portfolio at the end of every month. It is this rather simple idea that makes us who we are and why I think you picked us as a partner. If we can manage risk, our clients stay invested, and over time are able to take advantage of improving market conditions. I believe this is a recipe for investing success. So, while the U.S. stock markets have fallen off a cliff and dropped more than 20% in the past 90 days we have been reallocating and protecting against losses, consistent with the target drawdown of our portfolios. Below is how Cabana’s portfolios have performed since October 1 and YTD (through Monday, Dec. 24), net of all estimated fees and commissions, including up to a maximum 2% fee.

- Cabana Core Tactical Income 5 since October 1: -7.6%

- Cabana Core Tactical Income 5 YTD: -5.2%

- Cabana Core Tactical 7 since October 1: -7.5%

- Cabana Core Tactical 7 YTD: -6.9%

- Cabana Core Tactical 10 since October 1: -10.7%

- Cabana Core Tactical 10 YTD: -8.6%

- Cabana Core Tactical 13 since October 1: -14.1%

- Cabana Core Tactical 13 YTD: -12.9%

- Cabana Core Tactical 16 since October 1: -16.7%

- Cabana Core Tactical 16 YTD: -15.3%

- Cabana Core Tactical 20 since October 1: -15.7%

- Cabana Core Tactical 20 YTD: -14.9%

While we are not making money, we are losing a lot less than the broad U.S. and international equity markets. Just as importantly, we are staying within or around our target numbers, even in the worst investment conditions we have seen in a long, long time.

We have a week left of trading in the month and anything can happen, but I am extremely proud of what we have accomplished this year. I hope seeing this will provide some relief and perspective. We are not perfect, but I promise you we care and fight for you and your money every day.

I hope that everyone is taking some time to enjoy family and friends this holiday season. Those are always the things that matter most.

-G. Chadd Mason, CEO

Download a PDF of this commentary at the following link: Cabana Weekly Market Commentary December 24 2018

IMPORTANT DISCLOSURES:

This material is prepared by Cabana, LLC, dba Cabana Asset Management and/or its affiliates (together “Cabana”) for informational purposes only and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed reflect the judgement of the author, are as of the date of its publication and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Cabana to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by Cabana, its officers, employees or agents.

This material may contain ’forward looking’ information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of current or future results and should not be the sole factor of consideration when selecting a product or strategy. All investment strategies have the potential for profit or loss. All strategies have different degrees of risk. There is no guarantee that any specific investment or strategy will be suitable or profitable for a particular client. The information provided here is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation. Investment involves risk including possible loss of principal.

Cabana LLC, dba Cabana Asset Management (“Cabana”), is an SEC registered investment adviser with offices in Fayetteville, AR and Plano, TX The firm only transacts business in states where it is properly registered or is exempted from registration requirements. Registration as an investment adviser is not an endorsement of the firm by securities regulators and does not mean the adviser has achieved a specific level of skill or ability. Additional information regarding Cabana, including its fees, can be found in Cabana’s Form ADV, Part 2. A copy of which is available upon request or online at www.adviserinfo.sec.gov/.

The Financial Advisor Magazine 2018 Top 50 Fastest-Growing Firms ranking is not indicative of Cabana’s future performance and may not be representative of actual client experiences. Cabana did not pay a fee to participate in the ranking and survey and is not affiliated with Financial Advisor magazine. RIAs were ranked based on percentage growth in year-end 2017 AUM over year-end 2016 AUM with a minimum AUM of $250 million, assets per client, and growth in percentage assets per client. Visit www.fa-mag.com for more information regarding the ranking.

No current or prospective client should assume that the future performance of any specific investment or strategy will be profitable or equal to past performance levels. All investment strategies have the potential for profit or loss. All strategies have different degrees of risk. There is no guarantee that any specific investment or strategy will be suitable or profitable for any investor. Asset allocation and diversification will not necessarily improve an investor’s returns and cannot eliminate the risk of investment losses.

Cabana’s performance returns included in this material are estimates that have been calculated using actual account performance. The returns have not been independently examined by Cabana’s third-party GIPS (Global Investment Performance Standards) verification firm. Independently examined returns will be available in January. For additional information about Cabana and our performance methodology, please visit www.cabanaportfolio.com

Cabana claims compliance with the Global Investment Performance Standards (GIPS®). In addition to the firm’s third-party verification, six of Cabana’s core portfolios have been performance examined consistent with GIPS® standards. The Global Investment Performance Standards are a trademark of the CFA Institute. The CFA Institute has not been involved in the preparation or review of this report/advertisement. Verification assesses whether (1) the firm has complied with all the composite construction requirements of the GIPS standards on a firm-wide basis and (2) the firm’s policies and procedures are designed to calculate and present performance in compliance with the GIPS® standards. Verification does not ensure the accuracy of any specific composite presentation unless an independent performance examination has been conducted for a specific time period. Past performance is not indicative of future results. Due to various factors, including changing market conditions, the portfolios may no longer be reflective of current positions.