I hope everyone is enjoying some summertime and got to be with family over the July 4th holiday last week. Nothing is more important.

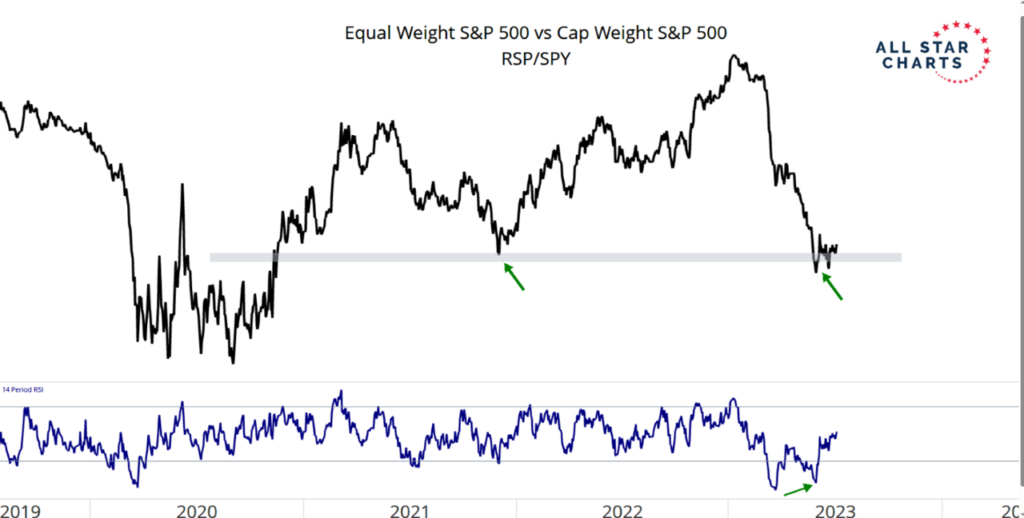

This week we got some good news on the inflation front, as both the consumer price index and producers price index came in lighter than forecast. We are also continuing to see market breadth improve and the equal weight S&P 500 is beginning to outperform the market cap weighted version that we see published all over television and other forms of financial media. If you read my commentaries often, you know that I am much more interested in the equal weight version because it is more representative of the overall economy, rather than a limited few giant technology companies. At Cabana, our portfolios are diversified and as such, we want to know about all the various sectors of the economy. I have included a chart (Chart 1) below of the relative performance of the equal weight S&P 500 vs. the market cap weighted version (RSP vs. SPY). This chart goes back to the COVID bear market in March 2020 and continues through July 13, 2023. As you can see, RSP led the way out of that bear market and continued to lead up until the middle of 2021. It was during this 15-month period that we saw the bulk of stock gains, which ended in January 2022.

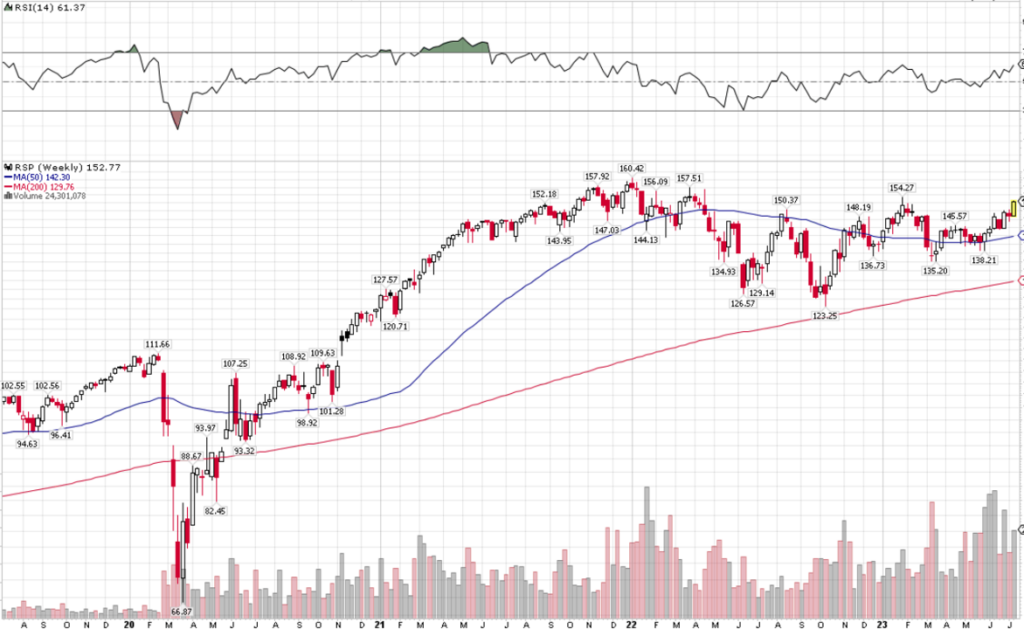

Another chart (Chart 2), which is also below, shows the absolute performance of RSP over the same time frame. You can see that the broad stock market began to peak at the same time as its relative performance vs SPY. This tells us that a bunch of companies’ stock began churning in the middle of 2021, despite big tech continuing to push the market cap weighted indices higher and higher for another six months.

We all know what happened next – and it is revealed in these charts as well. Technology (and by proxy the market cap weighted SPY) got crushed, as interest rates exploded in early 2022. The equal weight index didn’t have as far to fall because it hadn’t seen the same gains since the middle of 2021. This year has seen a massive rebound limited primarily to those big technology companies that ended 2022 down 30-50%. The rest of the market is still playing catch-up and that is what we are seeing now. Some much needed catch-up.

So, why am I so interested in this relative performance issue? Because we have been in a bear market since the beginning of 2022 and history tells us the equal weight index leads the way out of bear markets. And this history is not limited to the last one we saw in 2020. Chart 3 below shows the relative performance of RSP vs SPY since 2003. RSP conclusively outperformed coming out of each bear market we have seen this century (as well as other significant corrections). This includes the 2000-2003 tech bubble, the 2007-2009 financial crisis, corrections in 2011, 2015 and 2018, and the COVID bear market in 2020. I will feel a lot more confident when we see RSP break above the highs established in 2021.

Chart 1: RSP v. SPY Performance Since 2020

Source: Investopedia.com; as of July 10, 2023

Chart 2: RSP Absolute Performance Since 2020

Source: Stockcharts.com; July 2019-July 13, 2023

Chart 3: RSP v. SPY Performance Since 2003

Source: Stockcharts.com

While I am more hopeful every day in what we are seeing in stocks, it remains a fact that the yield curve is severely inverted and objective economic indicators suggest a near certainty that a recession will occur within the next year. The Confidence Board of Leading Economic Index (LEI) and the Federal Reserve Bank of NY Recession Probability Indicator are both deeply within territory that historically has resulted in a recession.

This all makes forecasting very difficult and is why I believe you have to have an objective process to follow. Nobody rings a bell signaling the all clear. It is always a struggle, and this market is that and more. We have a process at Cabana and while it is by no means perfect, it is what gets me through the day to day.

We remain in our Transitional Bearish scene (improving) having added equity exposure last month.