I spend a fair portion of time working and talking with my advisor partners about the markets, about Cabana’s methodology, and how we are communicating with clients. As you might suspect, we spend more time discussing these things when markets become difficult, and clients see portfolios drop in value as assets get repriced throughout the economic cycle. When things are very tough (like they are right now), we get deep into the weeds on the communication part. The reason is that we want our clients to understand what we are doing, why we are doing it, and that we have a plan. We want them to have a clear understanding of the process, so that they can make good decisions based on objective information rather than speculation or emotion. As advisors, we are fiduciaries and want what is best for our clients. We want them to succeed. With this background, I would like to pass on a conversation I had last week with one of my partners and his team.

This advisor has a large practice, does good work, and has for a long time. We were all discussing the difficulty people naturally have when investing in the public markets. We were talking about being constantly bombarded with information that is (in my opinion) largely irrelevant, the promotion of fear, feelings of helplessness and the like. The inability of many people to treat investments like investments, rather than a casino. The conversation ultimately centered around what we can do as professionals to help people deal with this apparent and unhealthy part of the investment process. Out of all this came an analogy that I think is a good one.

People need to think of their investment portfolio like they do their house. When they go to buy a house, they research it. They think about how long they want to live there and whether they should buy or rent. They factor in the location. They consider whether it might flood or face other risks. They look at the neighborhood and the schools. After all this, they make the decision to buy the house. It is most likely the largest investment they will make in their lifetimes. Then what do they do? They live in it. They raise children in it. The have celebrations in it. They watch pets live and die in it. Sometimes people too. When storms come and shingles get blown off, they repair it. They own it.

What they do not do each day is have their house appraised to determine whether today’s “value” is more or less than yesterday’s, or the value one week ago, or one month ago. Why not? Because they treat their home as an investment. They have confidence in the decision-making process that went into buying it and they know that over time it will likely increase in value. If someone suggested that we should have an independent appraisal done on our house every day to make sure it was increasing in value, we would likely think that person had lost their mind, yet that is exactly what we do with a very similar “investment”. We seek to appraise and re-appraise our investment portfolio every day. Worse yet, we have thousands of so called “experts” shouting at us from all directions about what the new appraisal means for the future. Things like, the location is not that good, the neighborhood school now has gangs in it, storms are likely going to take the roof off this year. Maybe it’s on an Indian burial ground. Well, you better sell it now! Can you imagine the insanity and emotional torment this would cause if this is what we did with the investment in our house? Can you imagine the increase in the divorce rate and the decrease in our quality of life?

Investing is like buying a house… or at least it should be.

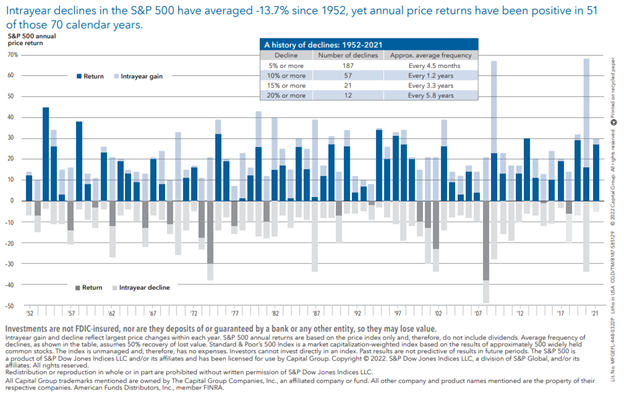

While on the topic of this tough market, below is an interesting chart that I came across today from The Capital Group Companies, Inc. While I have not checked these numbers myself, it does give me something to think about…