We have spent the past couple of commentaries looking under the hood, so to speak, of the equity market in an attempt to determine if the current rally has any legs to it – or is simply the next in a series of head fakes that we have endured during the past thirteen months.

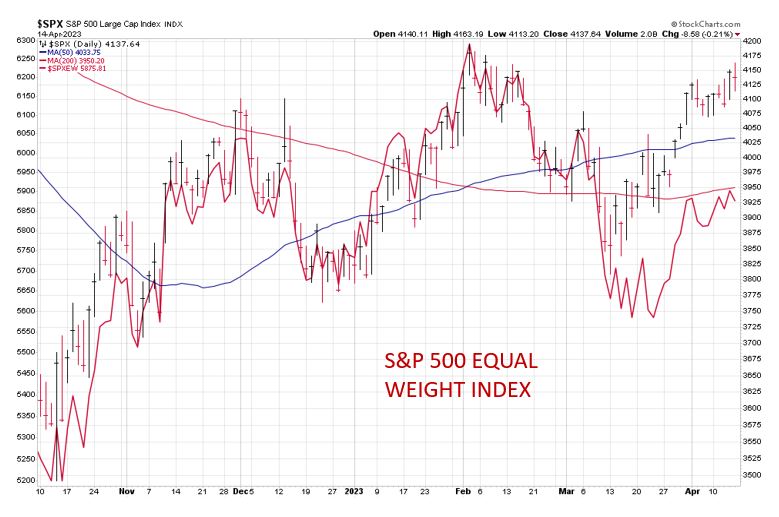

In the first of those, I laid out what we were seeing when looking at the market cap weighted S&P 500 vs. the equal weight version. It is the market cap weighted version that pops up on your TV every day. This is true for the Dow Jones Index and the Nasdaq as well. What each of these major indices does is overweight the performance of the largest stocks versus the rest of the stocks in the index. Thus, the reported “stock market” performance is skewed towards the largest companies. This becomes a real problem when some of those companies are so much bigger than all the rest, not to mention they all are the same type of company. The companies I am talking about include Apple, Amazon, Facebook (Meta), Microsoft and Tesla. These are absolute behemoths compared to all the other companies in these indices and they are all technology type stocks (and yes, they are in multiple indices at the same time). At the end of the day, what we really want to know is how everybody is doing in the current environment. A simple way to do that is to compare the performance of the market cap weighted S&P 500 to the equal weight index where everybody’s performance counts the same. As a general rule, it is a good thing when the equal weight index is doing as well as the market cap weighted index.

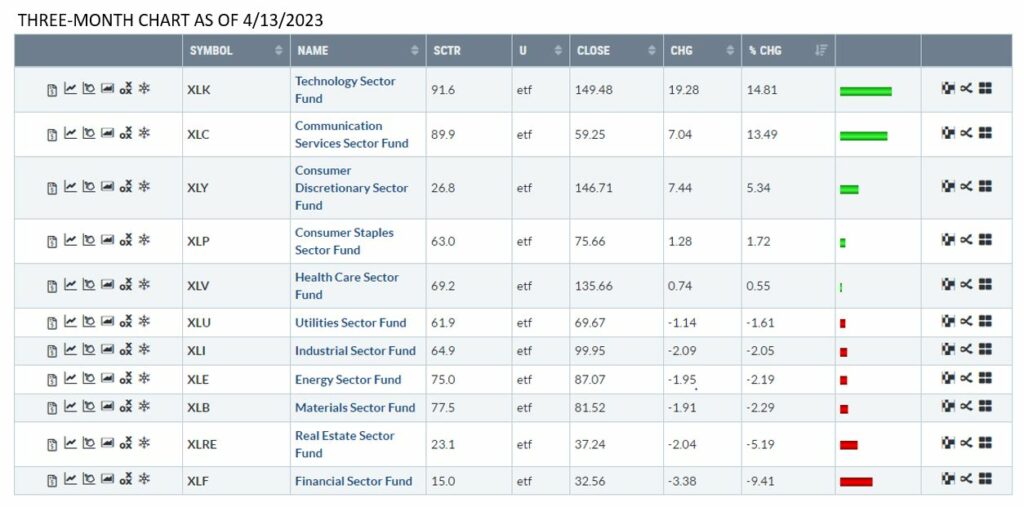

The second commentary I wrote over the past month (or so) included some charts and comments from our monthly advisor webinar reflecting what I consider to be the most important engines (sectors) that drive our economy. These were real estate, financials, industrials and transports. The sum of all this analyzing was that the current rally has been on the shoulders of just a very few mega cap tech companies and that while on its face it appeared the stock market was recovering from its latest swoon, there was a huge disparity between the haves and the have nots. Equally important, the have nots were some of the most important parts of the overall puzzle.

A few days after I wrote the first of those commentaries, the Wall Street Journal pointed out many of the same concerns and issues with underlying “breadth” within the rally. Maybe they read my commentary… or more likely they simply watch and read some of the same things that I do. This past weekend one of my favorite analysts, John Murphy, renowned market technician and founder of StockCharts.com wrote his weekly market message on exactly the same thing. Moreover, he provided some concise evidence via his charts to demonstrate the fact that the current positive performance in stocks has been confined to the market cap weighted index and mainly to only two sectors out of the 11 that make up the S&P 500. What were those two sectors? Technology and communication services. Both of which are made up largely of the stocks listed above. I have included Mr. Murphy’s data from last week below.

John Murphy S&P 500 Index Comparison as of April 6, 2023

John Murphy 3-Month Sector Comparison as of April 6, 2023

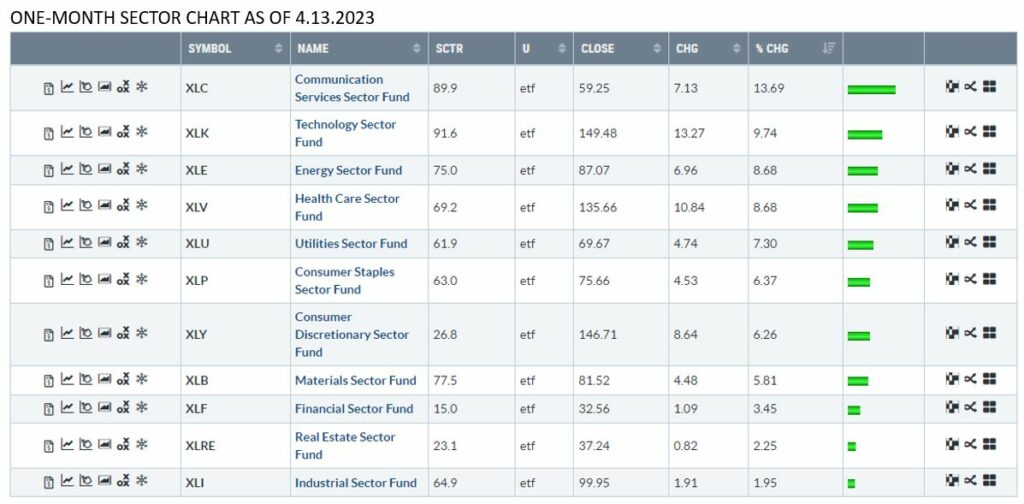

So, has anything changed over the past week to make our current situation a bit more hopeful? Well, we ran the exact same data after market close yesterday afternoon (Thursday) and lo and behold, we are seeing some improvement. The equal weight S&P 500 is starting to catch up and some other sectors are turning green, just over the past four trading days. For good measure, I ran the last chart over only the past month and we are green across the board. Even financials are getting bought. See the updated charts below.

S&P 500 Index Comparison as of April 13, 2023

3-Month Sector Comparison as of April 13, 2023

1-Month Sector Comparison as of April 13, 2023

To me, this is a good sign that we can move higher. Inflation and interest rates have likely peaked, which is a necessary condition for the next bull market to begin. The Fed has now formally acknowledged in its minutes released this week that a recession is likely. I think acknowledgement by the fed of a deteriorating economy is the first step in a pivot to start helping instead of hurting. Do we have problems ahead? Of course. And maybe very big ones. The extent of the damage done to banks and commercial real estate as well as other interest rate sensitive businesses has yet to be felt. We are also just now expecting to see signs of weakness in the broad economy. So, we are very much not out of the woods, but then again, we never are. Investing is all about finding a path through the woods – however accommodating or threatening they may be.

At Cabana, due to improving technical conditions, we released our Safety Valve allocations and are normally allocated within our Bearish Scene. We are prepared to reallocate to add risk assets should CARA (Cabana’s Cyclical Asset Reallocation Algorithm) signal a change.