Just as quickly as the drumbeats of war with Iran quieted, we became overwhelmed with news of a rapidly spreading potential pandemic coronavirus. The virus started in China and has now been found in numerous countries around the world, including the United States. It is currently projected to be less severe than the SARS virus, which started in 2003 (also in Asia) and ultimately infected 8,000 people and killed 774 of those. These viruses are related to the common cold and pneumonia. The vast majority of those infected recover with mild to moderate symptoms. To put this in perspective, influenza infected more than 43 million people and killed 57,000 in 2019. The flu killed 80,000 in 2018. If you want to worry about something, the flu would be a worthy candidate.

While a worldwide health epidemic can certainly impact trade, travel and business activity, it is these factors’ impact on corporate earnings that ultimately dictate asset class performance. Equity markets around the world have sold off as word of the virus reached the forefront of our collective attention. The S&P 500 has dropped more than 3% in the past four trading days. China has dropped 10% in the face of quarantines and restricted travel during the Chinese Lunar New Year. Energy stocks have also taken a hit as investors predict reduced demand for fuel. Bond yields across the yield curve have followed suit and dropped precipitously. The 10-Year Treasury Note is trading at 1.60% after being as high as 1.90% two weeks ago.

So, is all this coronavirus concern justified or is it just a good excuse for some profit taking after a big unabated run-up in stocks? I mentioned last week that markets were priced to perfection, with investors clearly expecting strong earnings this month. According to FactSet Financial Data, 85 companies within the S&P 500 have reported Q4 2019 earnings and 62 of those (73%) have beaten earnings estimates. Out of those reporting, 57 (67%) have reported revenues above forecasts. Pretty good numbers indeed. Year-over-year average earnings growth remains at positive 8%. The question now becomes whether the fallout from the coronavirus is going to cause these numbers to fall going forward. Of course, no one knows for sure what can happen when a heretofore unknown virus makes inroads into the human population.

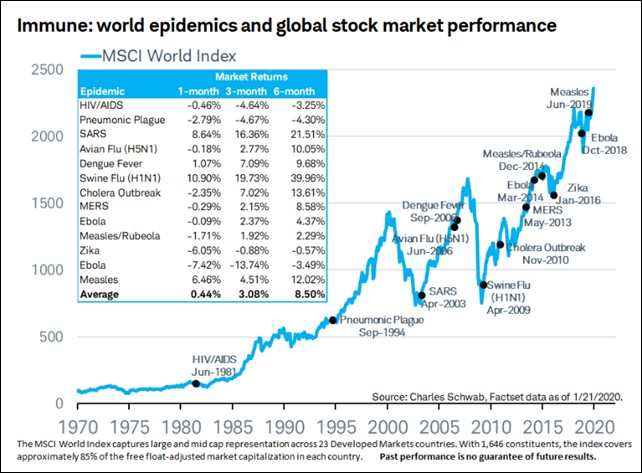

All we can do is look to history for some guidance (just like we did earlier this month when trying to discern whether military conflict was bad for corporate earnings and equity investments). See below for a chart courtesy of Dow Jones, which tracks U.S. market performance over the ensuing 6 and 12 months, following the occurrence of an epidemic as described by the World Health Organization. Interestingly, in almost every instance going back to 1981 and the AIDS epidemic, markets are higher after both 6 and 12 months. The same is true of international markets, as evidenced by the second chart below, provided courtesy of Charles Schwab and FactSet.

The fact is that epidemics don’t matter with respect to equity markets…until they matter! When and how they might matter is anyone’s guess. We will continue to watch earnings as they roll in.

A PDF of this week’s commentary is available at the following link: