Did you know you can receive a tax credit just for participating in your employer-sponsored retirement plan? Most people don’t! In fact, only 1 in 8 who are eligible actually take advantage of it. If you contributed to your company’s 401(k) or 403(b) plan in 2018, you could be eligible.

If you qualify, you may receive a Tax Saver’s Credit of up to $2,000 ($4,000 for married couples filing jointly) if you made eligible contributions to an employer sponsored retirement savings plan. The deduction is claimed in the form of a non-refundable tax credit, ranging from 10% to 50% of your annual contribution.

Remember, when you contribute a portion of each paycheck into the plan on a pre-tax basis, you are reducing the amount of your income subject to federal taxation. And, those assets grow tax-deferred until you receive a distribution. If you qualify for the Tax Saver’s Credit, you may even further reduce your taxes.

Your eligibility depends on your Adjusted Gross Income (AGI), your tax filing status, and your retirement contributions. To qualify for the credit, you must be age 18 or older and cannot be a full-time student or claimed as a dependent on someone else’s tax return.

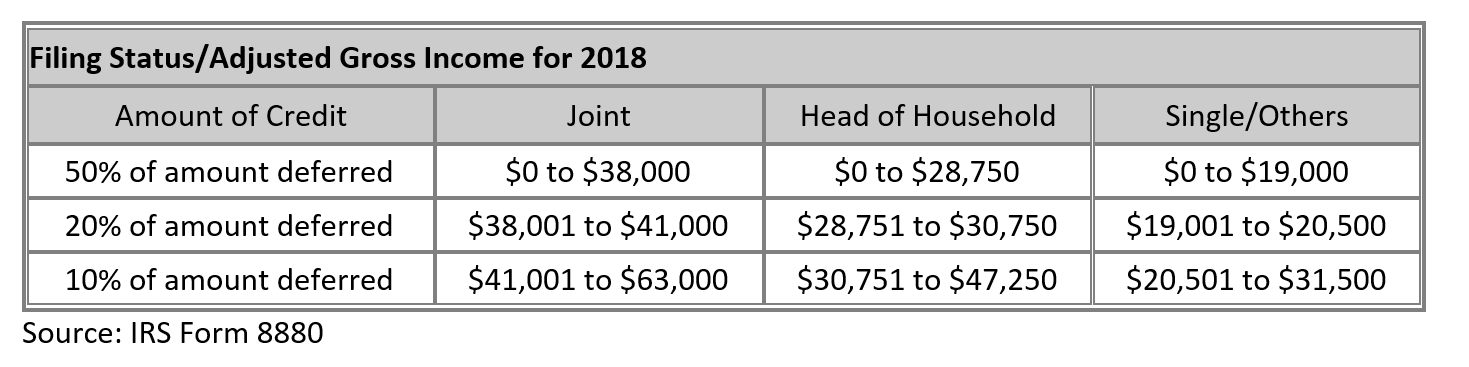

Use this chart to calculate your credit for the tax year 2018. First, determine your Adjusted Gross Income (AGI) – your total income minus all qualified deductions. Then refer to the chart below to see how much you can claim as a tax credit if you qualify.

For example:

- A single employee whose AGI is $18,000 defers $2,000 to her retirement plan will qualify for a tax credit equal to 50% of her total contribution. That’s a tax savings of $1,000.

- A married couple, filing jointly, with a combined AGI of $38,000 each contributes $1,000 to their respective company plans, for a total contribution of $2,000. They will receive a 20% credit reducing their tax bill by $400.

With the Tax Saver’s Credit, you may owe less in federal taxes the next time you file by contributing to your retirement plan today! Make sure to speak with your tax professional to see if you are eligible.

This information and the examples are provided as general information and illustrative purposes only. This is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor regarding your individual situation.

Disclaimers:

Cabana LLC (dba “Cabana Asset Management” and “Cabana Retirement Solutions”), is an SEC registered investment adviser with offices in Fayetteville, AR and Plano, TX The firm only transacts business in states where it is properly registered or is exempted from registration requirements. Registration as an investment adviser is not an endorsement of the firm by securities regulators and does not mean the adviser has achieved a specific level of skill or ability. Additional information regarding Cabana, including its fees, can be found in Cabana’s Form ADV, Part 2. A copy of which is available upon request or online at https://www.adviserinfo.sec.gov/.

By using this website the user agrees as follows:

All written content on http://cabanaportfolio.com website (the “Website”) is for informational purposes only. The material presented is believed to be from reliable sources and no representations are made by Cabana, LLC, Cabana Law Group, or Cabana Financial, LLC (collectively, “Cabana”) or its affiliates as to another parties’ informational accuracy or completeness. All information or ideas provided should be discussed in detail with a financial advisor, accountant or legal counsel prior to implementation. No party, including but not limited to, Cabana and its affiliates, assumes liability for any loss or damage resulting from errors or omissions or reliance on or use of this material.

The views and opinions expressed are those of the authors do not necessarily reflect the official policy or position of Cabana or its affiliates. Any content provided by our bloggers or authors are of their opinion, and are not intended to malign any religion, ethnic group, club, organization, company, individual or anyone or anything.

Information presented is believed to be current. It should not be viewed as personalized investment advice. All expressions of opinion reflect the judgment of the authors on the date of publication and may change in response to market conditions. You should consult with a financial advisor before implementing any strategies discussed. Content should not be viewed as an offer to buy or sell any of the securities mentioned or as legal or tax advice. You should always consult an attorney or tax professional regarding your specific legal or tax situation.

Viewers or recipients of the information herein that do not agree with the term and conditions of use, should not utilize this website or any information contained herein. Decisions based on information contained herein are the sole responsibility of the person viewing the website. In exchange for utilizing the information on this website, the visitor agrees to indemnify and hold Cabana, its officers, directors, employees, affiliates, agents, licensors and suppliers harmless against any and all claims, losses, liability, costs and expenses (including but not limited to attorneys’ fees) arising from the use of this website, violation of these terms or from any decisions that the viewer makes based on such information.

Please consult with a tax advisor before making any investment decisions.