I hope everyone had a great holiday season and was able to focus on time with family and friends. Sometimes that isn’t easy, as the barrage of pressures can be relentless and unfortunately, can make it difficult to focus on what is really important. I think it is good to always remember that we are all in this together and everybody is facing the same things. So, together let’s have a great 2025 and be the best we can be.

As far as the markets and investing go, we have seen interest rates explode upward again on renewed fears of inflation and an unbelievably strong U.S. economy. The 10-Year Treasury Yield is now higher than it was one year ago. That is amazing given the outlook for rate cuts at the beginning of last year. The challenges to bonds, fixed income, dividend paying stocks and other interest rate sensitive sectors roll on.

Bonds were down again in 2024, concluding the worst three year stretch since 1787. Real estate also saw losses. Health care, energy, and basic materials fought to avoid annual losses. Other sectors finished in the black with some room to spare. The big winner in all this has again been big technology stocks, which have ridden the AI craze, and now make up more than 30% of the broad market cap-weighed indices that we see quoted on CNBC and other media outlets.

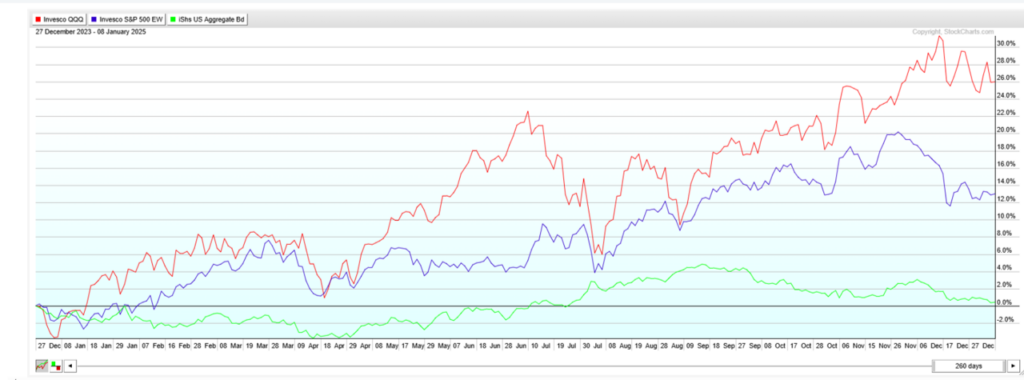

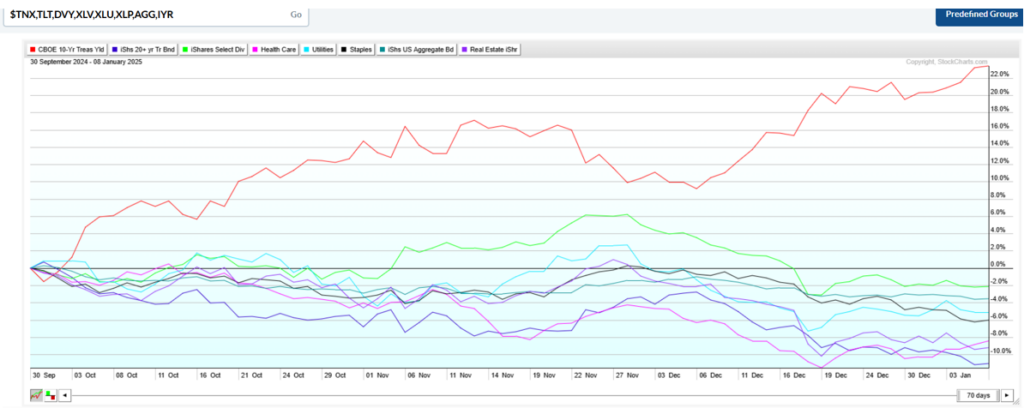

I have included two charts below for a visual depiction of what I am talking about. The first shows the 2024 returns of the tech laden Nasdaq 100 (QQQ), the equal weight S&P 500 (RSP) and the aggregate bond index (AGG). The second chart shows the impact rapidly rising interest rates have recently had on bonds and some market sectors outside of tech.

Nasdaq 100 (QQQ), the Equal Weight S&P 500 (RSP) and the Aggregate Bond Index (AGG) Since September (via StockCharts.com):

Bonds and Market Sectors (Outside of Tech) Since September (via StockCharts.com):

The bottom line is that many stock sectors and most asset classes (bonds, real estate and commodities) have struggled in the face of relentless interest rate pressures. Don’t be fooled into thinking the “market” has been great, because that is not the case. One segment of the stock market, made up of the largest companies in human history, has been great. So, this begs the question “why not just invest in technology and forget the rest?” This is a fair question given what we have seen over the past couple of years and one I have asked myself. Maybe things are just different now and nothing else really matters. Maybe times have changed, and technology is impervious to the dynamics of monetary and fiscal policy. Maybe AI changes everything. I don’t have the answer, but I do know that the same was said in 1999 when the internet was the all-powerful new technology. Two years and hundreds of bankruptcies later the Nasdaq 100 was down 77% (October 4, 2002).

At Cabana, we are “all asset” managers. That means that we are invested in all the major asset classes. This includes stock sectors of all types (not just technology), bonds, real estate, commodities and the U.S. Dollar (which is the reserve currency of the world). We change the weighting of the asset classes in response to various economic and technical data, but we are always diversified. We also have rules related to risk management. These rules prohibit taking on too much exposure to any given asset class or sector (like technology). This is all by design and the result of managing money for a long time. We are investors not traders and we are not trying to hit home runs. We try to hit lots of singles and an occasional double while avoiding a strike out. We strive to act as a core investment solution for all investors. Yeah, we have had some big years, but that was gravy. Our underlying principle is to avoid losses, stay invested and participate in long-term price appreciation across asset classes.

I have had lots of conversations over the past two years with our advisor partners and family office clients about these issues and some have decided that our system is not for them. That is ok. I want everybody to be successful, whether they are invested with us or somewhere else. Just know that at Cabana, we invest your money like we invest our money. It doesn’t mean we are right, but it does mean we believe in what we do.

We will be having our year-in-review webinar for all our clients at the end of this month and will go over all of the above and much more, including new opportunities for this year. Be on the lookout for the invitation and be ready to participate! As always, thank you for your partnership and trust.

We are currently Cautiously Bullish.