We had our quarterly workshop in Dallas last week and I want to thank our partners around the country who came down and worked with us. I can’t tell you how much these mean to me personally and to Cabana as a whole. I leave each of these with new ideas and renewed passion to get better. I believe that every person in that room cares about their clients and is fighting the good fight every day no matter the circumstances. With all the bad things happening in the world, it gives me hope to see some sunlight in the form of sincere people.

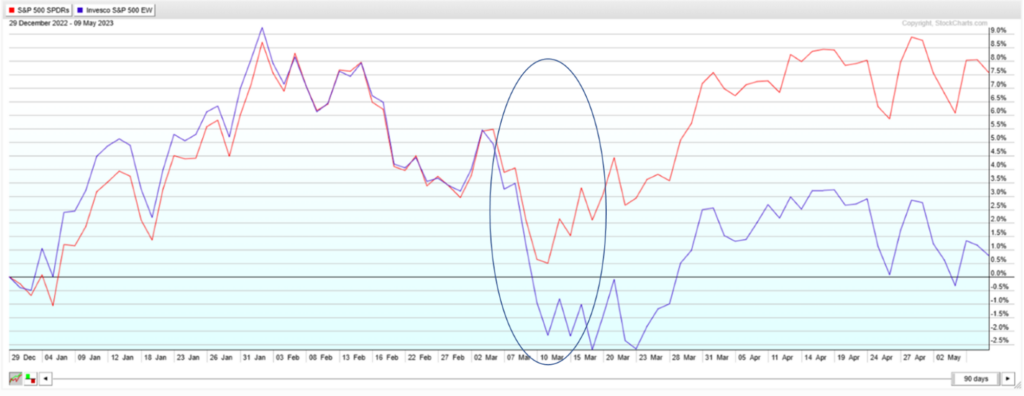

The stock market continues to grind nowhere and we’re seeing de-coupling between the mega cap tech stocks and everything else. We spent quite a bit of time on this issue during our workshop. I have talked about this many times over the past weeks and the sum of my position is that it is not good when only a few stocks are carrying the market and the rest are on their knees. An easy way to gauge this is to compare the market cap weighted S&P 500 (SPY) and the equal weighted version (RSP). It is a good thing when the equal weight version is leading the way as it evidences broad participation by all the companies that make up our economy. See the chart below for a visual of what I am talking about.

Source: Stockcharts.com as of 5/9/2023.

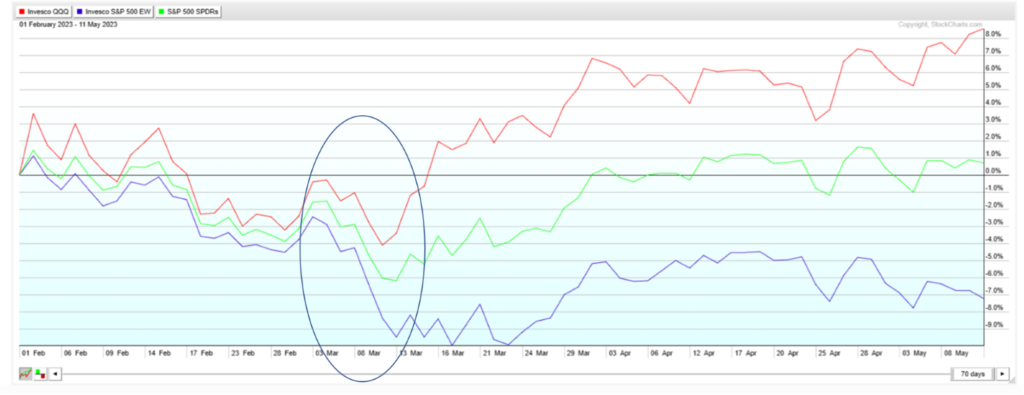

Comparing the Nasdaq (QQQ) is even more revealing. These benchmarks decoupled in the middle of March and have remained so since that time. The timing of the decoupling coincided with interest rates topping out and bond prices beginning to turn up (see below chart).

Source: Stockcharts.com as of 5/12/2023.

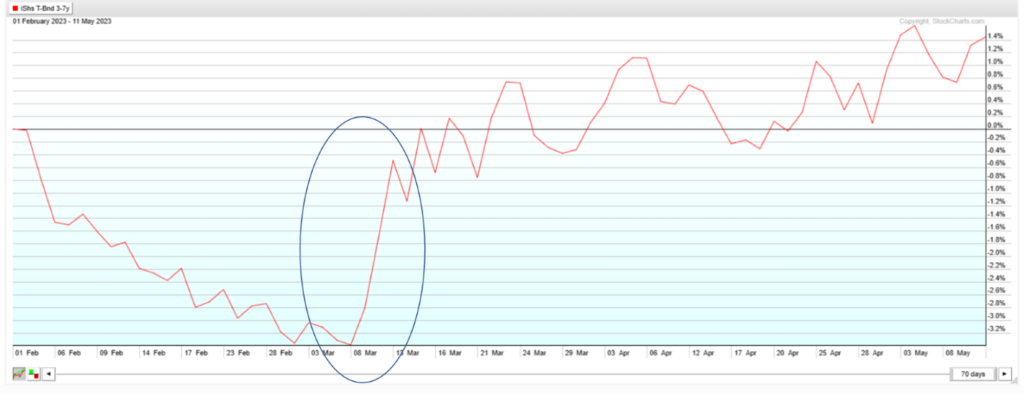

The good news is that we need bond prices to turn up before the stock market can stabilize and begin a new bull cycle. I think we are at the beginning of this process now. Unfortunately, there is no guarantee of how long the bottoming process in stocks will take. Maybe the low in October was it and we are simply consolidating above that level before shifting in to gear and moving higher. That is the optimistic view of things. I think a more realistic and “historical view” would be that bonds are just now turning up and stocks need to fall further before they can begin a new cycle of rebirth. I would like to also point out that the third horseman in all this is commodities. They typically turn last. It looks to me like they have also topped out and have turned down. That is also good and is why bond prices are turning up (see below chart). So, the typical order of things as bull markets end is that bonds prices top out first, followed by stocks and finally commodities. We saw bonds turn down in 2021, stocks turned down in early 2022 and commodities later in 2022. We are seeing bonds now turn up and with this logic, next will be stocks!!! When? I don’t know, but we are watching closely.

Source: Stockcharts.com as of 5/12/2023.

The next few weeks are likely to be highly volatile due to political wrangling over the debt ceiling and the potential for a first ever default by the United States. This will impact both stocks and bonds and is unfortunate. It’s my opinion that no one in their right mind and cares about this country would allow a default to occur. It does not matter how far left or right you are on the political spectrum, an actual default would permanently change what it means to be the United States of America and our place in the world. Everybody knows this so the rest of the jawboning is just dangerous and painful. Don’t we have enough pain and worry out there without self-inflicting some more? Expect a lot of bouncing around in the stock and bond market as this plays out, but in the end we will not default. If we do, we are no longer the world leader. Period.

At Cabana, we remain bearish and are allocated accordingly.