The past week has seen lower prices across all the major stock indices, but the selling has been especially pronounced in technology, AI-related stocks and beloved Bitcoin. These high-flying investments have been sarcastically referred to as the “Bro Trade” and have made up most of the big returns seen by investors over the last two years. We began picking up on signs of this rotation several weeks ago and you can read my thoughts on it in past commentaries. I believe this is inevitable and as the economy normalizes, we will see valuations and earnings begin to matter again. With bond yields (10-Year Treasury) now north of 4% (as of this writing) and corporate grade bonds paying even more, stocks have a legitimate competitor for investor money.

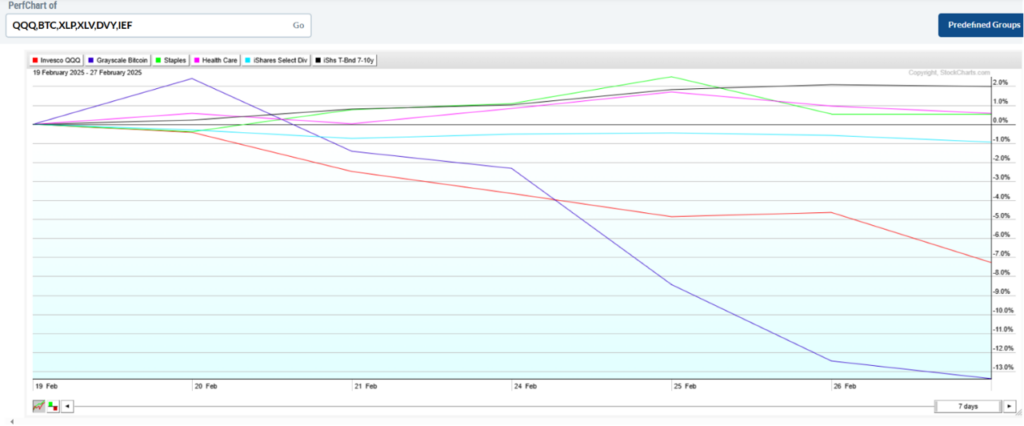

All this plays into the movement out of technology stocks that don’t have current positive earnings or whose valuations (price) relative to their earnings is too high. This dynamic also tends to get rid of the “casino” type mentality that prevailed during the Covid era. After all, investing is (or at least should be) serious business. What we have seen in many instances with meme stocks and other “investments” is neither serious nor fundamentally reasoned. Below is a seven-day chart of the Nasdaq 100 (QQQ) and Bitcoin (BTC) compared to consumer staples (XLP), health care (XLV), dividend payers (DVY) and the 7–10-year treasury ETF (IEF). It is obvious what is being sold and what is not.

As of 2/28/2025 via StockCharts.com:

There are lots of other issues and unknowns out there, as there always are. These currently include tariffs causing rising inflation pressures, ongoing war and a reversal of globalism, which has resulted in significant cost efficiencies over the past 40 years. Undoubtedly these will have an impact on companies doing business here in the U.S. and abroad. Ultimately, those impacts will show up as they always do in earnings, interest rates and stock prices. The assimilation and response to these data points is what investing is about.

What is most notable to me right now is that the days of gambling on the advice of some “influencer” or chasing the latest fad seems to be coming to an end – and for many I am afraid it will not end well.

Earnings remain strong and unemployment remains historically low for the time being. As such, we remain in a “bull market” but what that means for many investors is changing.

At Cabana, we remain in our Bullish Scene.

Terms to know:

- The Invesco QQQ ETF is an exchange-traded fund (ETF) that tracks the Nasdaq 100 Index.

- Grayscale Bitcoin Trust ETF is solely and passively invested in Bitcoin. Its investment objective is to reflect the value of Bitcoin held by the Trust, less expenses and other liabilities.

- The XLP, or Consumer Staples Sector ETF, includes companies involved in the development & production of consumer products such as food & drug retailing and household or personal products.

- The Health Care Select Sector SPDR Fund (XLV) is an exchange-traded fund that is based on the Health Care Select Sector index. The fund tracks health care stocks from within the S&P 500 Index, weighted by market cap.

- The iShares Select Dividend ETF (DVY) seeks to track the investment results of an index composed of relatively high dividend paying U.S. equities.

- The iShares 7-10 Year Treasury Bond ETF (IEF) seeks to track the investment results of an index composed of U.S. Treasury bonds with remaining maturities between seven and ten years.