Stocks and bonds continue to move in response to interest rates. Rising rates have resulted in falling stocks and bond prices for the past two months. The focus last week was on jobs data and whether the relative strength or weakness will move the Fed to raise rates again or end its inflation fighting campaign – and maybe even cut rates sometime in 2024. The all-important 10-Year Treasury bond climbed all the way to 4.8% early in the week before a weak payroll report on Wednesday dropped rates and caused stocks to bounce. All eyes then turned to Friday’s unemployment report. The consensus going in was that if the number of new jobs created last month exceeded estimates of 170k, yields would rise, and stocks would resume their decline. That makes sense considering what we just saw on Wednesday. Well, the number came in way above estimates at 336k. Just as predicted, stocks and bonds immediately sold off and the 10-Year Treasury jumped to 4.86%. Then the entire market complex reversed, and stocks finished the day up almost 1% and the 10-Year yield pulled back below 4.8%. This is a head scratcher to say the least and we will have to see how this plays out over the next few days.

What is pretty clear to me is that the stock market is trying to hold support at the 420 level (SPY). The market-cap weighted S&P 500 (SPY) and Nasdaq are about the only soldiers left on the field. The Dow, aggregate bond index, treasuries, small cap index, equal weight S&P 500 (RSP) and most sectors of the S&P 500 have turned negative for the year and are below their 50- and 200-day moving averages. As such, a break below 420 will likely result in more selling of stocks.

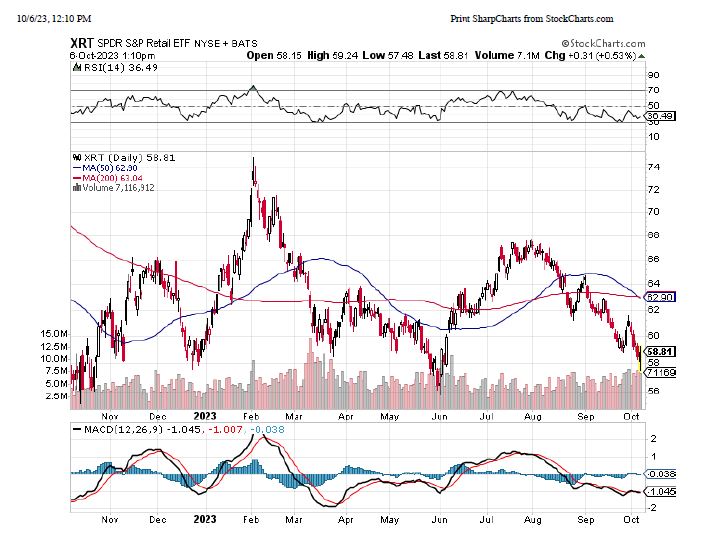

Another index to watch as a recession indicator is the retail sector (XRT). This reflects companies sensitive to consumer spending. It is consumer spending that accounts for the majority of the nation’s GDP. With rates still rising, it is worth thinking about the tapping out point. I’ve included a one-year chart of XRT below. In my view, this is further evidence of the precarious situation our economy finds itself in. Data like jobs numbers are backward looking and the stock market is forward looking. If you take that as true, then the consumer has some struggles ahead.

One of our Dallas family office clients had a good question last week about how the market could be still bullish overall but at Cabana, we are in bearish positions. I thought it was important to explain. Our system, Cabana’s Cyclical Asset Reallocation Algorithm (CARA) segments the market into what we call “scenes”. This is done through aggregating fundamental and technical data to give us an idea of how the economy is doing and, by proxy, the markets. There are several layers to this, and we try not to predict the future but rather invest based upon what is in front of us today. Typically, market indices, as well as fundamental data like earnings and interest rates are correlated and track one another. Occasionally, they disconnect and don’t track. That has been the case for much of the past eighteen months. This can result in volatility whereby stocks and bond prices whipsaw in large moves in both directions. We have touched on this several times this year including last week, and it remains the case today.

CARA is designed to protect first and respond to corrections – even in bull markets. After all, we never know when a “correction” is going to become something worse. Right now, much of the stock market is struggling and the bond market is in a historic bear market. Big tech is the exception, and it has become in many ways the driver of economic growth in this country. It is that segment that has pulled us forward this year – and that is the bull market that I refer to. CARA has signaled a return to a bear market allocation as a result of deteriorating conditions across all stocks. That is why our current holdings are “bearish”. She doesn’t watch the technology sector independently and is not concerned per se with one or two or even three sectors. She tries to evaluate how everyone is doing. And right now, “everyone” is struggling. I however watch other things and comment on what I see outside of CARA. Right now, I see that a new bull market remains in play because of the resilience of big tech and its effect on other market participants, including individual investors and their psychology. But we do NOT invest based on what I think. We invest based upon CARA’s output.

Our Target Drawdown Portfolios are in our Safety Valve and Bearish Scene, allocated to short duration treasuries. Our Target Beta Portfolios are allocated consistent with their Target Beta in a Bearish Scene.

1-Year XRT Performance as of 10.6.2023: