Stocks spent last week bouncing from oversold conditions that resulted from the pullback that began in August. The market-leading Nasdaq and cap-weighted S&P 500 found support just above their 200-day moving averages and, importantly, for the S&P 500 just above the important 420 level (SPY). I have included a six-month chart below for reference. The broader stock complex (RSP) found support at early summer lows, but well below both the 50- and 200-day moving average. I have included a chart of that as well. Nothing has changed, as big tech continues to be the only game in town. All other sectors are struggling and this needs to change in my opinion.

The buying that we have seen during the past week has coincided with a drop in bond yields as predicted. Yields were extended and due for a pullback after the huge jump over the past six weeks. Traders stepped in and took advantage of a “coupled” trade and made some quick profits. Whether the last few days can lead to a more sustained rally leading into the year’s end remains to be seen. Quite a bit of technical damage has been done in multiple sectors. As I pointed out over the past few weeks, if support holds at that 420 level (SPY), I think we have a shot.

It is difficult to adequately describe how unique this investment climate has been over the past eighteen months as bonds have been pummeled, with yields skyrocketing and stocks whipsawing, but not breaking. The yield curve remains significantly inverted and the Fed continues to withdraw liquidity from the system. By all historical accounts we should be in recession, yet the economy appears to remain robust, and the consumer keeps on spending. It is really amazing to me, and I wonder how future generations of investors will look back on these times.

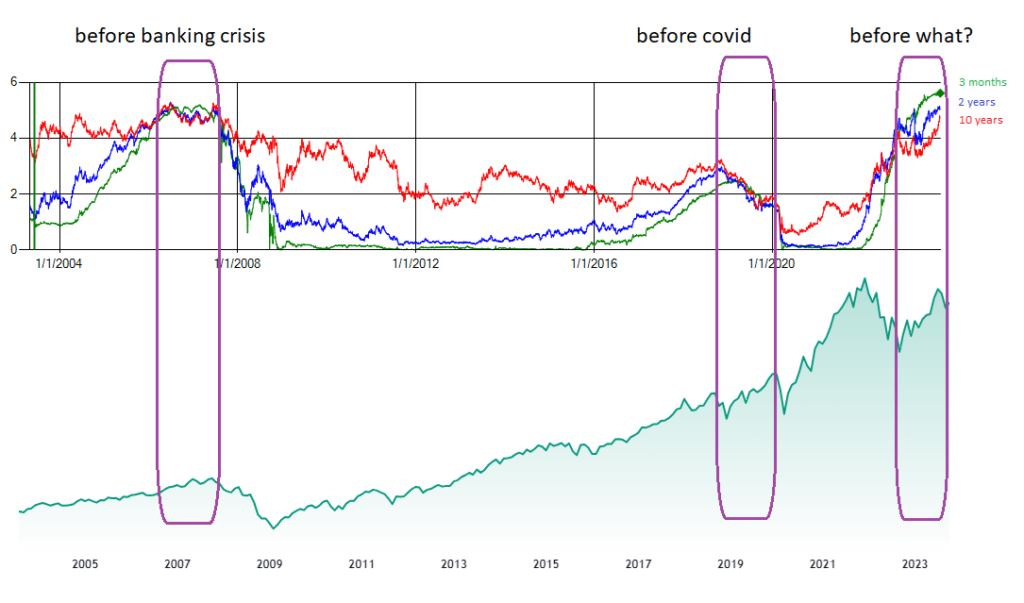

As many of you know, I believe the bond market usually sees things first and is where the smart money spends most of its time. That is why we watch the yield curve closely and why it is built into CARA (our Cyclical Asset Reallocation Algorithm) as a fundamental indicator. When the yield curve is inverted, bond investors are willing to tie up their money for longer periods of time for less return than if they loaned it out for shorter periods of time. This only makes sense if you believe interest rates are going to fall enough in the future for your payment on the long-term bond to be a lot more than will be available at the later date. Interest rates fall in times of economic weakness. This is why yield curve inversion historically has preceded recessions and bear markets. We have had the current inversion for some eighteen months but no economic weakness. So, what does this mean for the big picture going forward? That is the question. The final image below is a snapshot of our yield curve indicator in addition to the S&P 500 from 2007 until now. The red line (long term bonds) should be above the blue and green lines (short term bonds). This “normal” condition also coincides with bull markets, as you can see. Our chart shows three inversions, 2007, 2019 and current. The previous inversions ended with the financial crisis and the pandemic recession of 2020. Is 2024 going to bring something similar or is this time somehow different? I’ll let you decide for yourself.

Earnings season kicked off on Friday and we will have more information on profits, the consumer and forecasts over the next few weeks. This will likely dictate whether we get a year-end rally before the 2024 question gets answered.

We are in our Bearish Scene and in our Safety Valve positions in our Target Drawdown Portfolios as well as our Target Income Portfolio. Our Target Beta Portfolios are in their Bearish Scene allocations.

SPY over the past six months from Stockcharts.com (as of 10/13/2023):

RSP over the past six months from Stockcharts.com (as of 10/16/2023):

Cabana’s Yield Curve Indicator (snapshot from CARA):