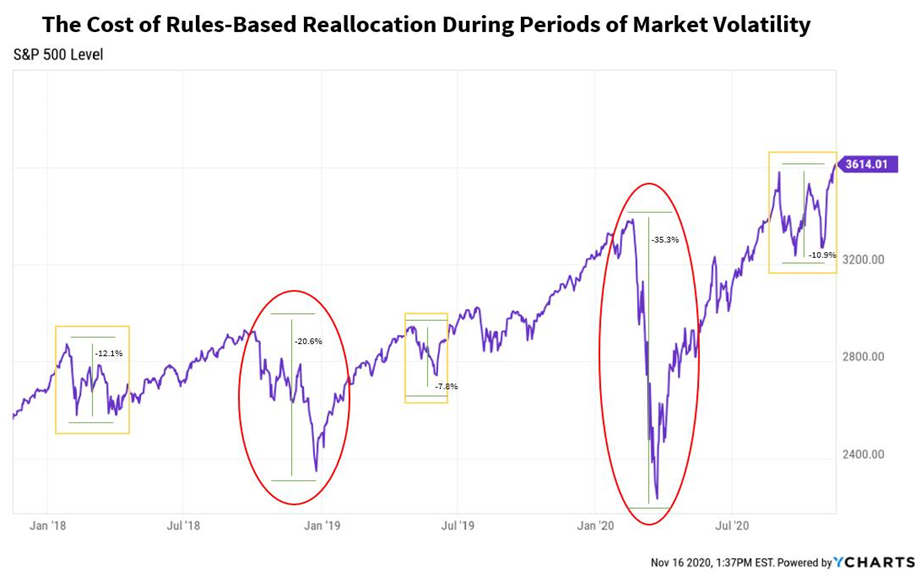

For a change this week, I’d like to provide some insight into what it means (good and bad) to have a rules-based process. There is a chart of the S&P 500 over the past three years for reference on Page 2 of this commentary.

My idea for this week’s commentary comes as a result of two different conversations that I have had with professional advisor partners over the past week. The first advisor lives in California and uses our Target Drawdown Professional 10 almost exclusively. He and I met a year or so ago when I was speaking at a conference in Newport Beach. During our phone call he asked me how I was able to hold up emotionally/psychologically during this incredibly difficult year. What he meant by the question was that he understood how hard it is to make investment decisions for thousands of people out there, even in normal years. He could only imagine what that must be like in a year like 2020, when we have truly entered uncharted and very scary waters. The second advisor is from Florida and he also uses our Target Drawdown Professional Series Portfolios. He asked me how to explain to a client the ups and downs of our portfolios since the market top at the beginning of September and, particularly, since the election at the beginning of November. He has a client who wanted to know why we recently seem to be down on days that the market is down, and not up as much on days that the market is up.

Both of above described questions can be answered by the fact that we follow a rules-based process all the time. Let me explain. We have worked over the better part of two decades to build our portfolios with risk management at the forefront. We even put an intended target drawdown percentage on each portfolio. We tell clients up front that we strive for our portfolios to stay within an easy-to-understand numerical percentage (drawdown) through all market types. I will note that target drawdown percentages are just that – targets, not guarantees. So, why do we do it this way? We believe that there are only three main objectives that must be met for an investor to do well over a reasonable investment horizon of three to five years. First, an investor must engage in the investment process. We are all much more likely to get involved in this wonderful world of investing if we understand the risk involved when things turn south. Things always turn south sooner or later. By putting that targeted risk right on the front page in a way that anyone can understand, we give investors an opportunity to truly invest in something they understand and are comfortable with. Second, an investor must avoid large losses. This is simple math. If an investor loses 50 percent of his/her portfolio’s value at any given time, he/she has to make 100 percent back just to get even! Big losses are a killer. Third, an investor must stay invested. Public markets move up and down all the time, but over time they typically go up. Did you know that over any 20-year rolling period going back to the 1800’s, the S&P 500 (or its proxy) has ended the 20-year period higher than it began? I cannot guarantee this in the future, but it is absolutely worth considering.

Our rules-based process seeks to meet all three of these objectives. We provide an easy-to-understand investment process that addresses what is on every investor’s mind at the outset. As a result, investors get involved. He or she simply picks his or her drawdown number and off we go. Second, when bad times come, we remove risk incrementally and strive for all Target Drawdown Series products to stay at or around their intended drawdown number. The goal is to limit large losses and encourage the investor to have confidence in his or her decision. This makes it extremely likely he or she will stay invested over the longer term. We believe that is all there is to it.

At Cabana, we focus entirely on maintaining our target drawdown percentage. We model all types of conditions over the past 20 years so that we have an idea of what allocation mix we believe (via our algorithm) offers the most protection as we move throughout the repeating economic cycle. Our more conservative portfolios are designed to protect more than our more aggressive portfolios. As such, the more conservative portfolios typically have more inverse or non-correlated assets at any given time than do our more aggressive portfolios. What all portfolios have in common is that they respond to deteriorating or improving markets by removing or adding risk when things change. These are the rules, and they are designed to protect drawdown first, even if that means missing short-term gains or keeping up with the Dow or S&P 500. This also means that we move when our system tells us to move – even if it is possible that we are wrong, and the selloff is just a regular old-fashioned pullback and not something more serious. It is our process that provides the answer to each of my partners’ questions. We are able to deal with the highs and lows of investing, even when we are scared and feel unsure, because we have a process to fall back on that has been built over years and years and all types of markets. Along with this, we are not trying to outsmart anyone. We just want to meet our three easy objectives. That is the good. This same process explains why during periods of market volatility we are likely to underperform. We always err on the side of protecting principal and seek to avoid a large loss (drawdown). When market and fundamental conditions become threatening, we seek to protect first and ask questions later. We believe there is time to make money when conditions improve. Everyone always wants to avoid losses and at the same time always make money. Unfortunately, that is not how it works in investing. Sometimes you must make a choice. That is the bad. At Cabana, we prioritize minimizing losses.

The chart below gives some perspective on what I mean by prioritizing the protection of losses, even when it comes at the cost of short-term gains. Implied in this is the fact that some rules-based process is necessary in the world of professional money management. Without it there would not be very many old money managers. The yellow highlighted boxes represent times over the last three years whereby our algorithm, CARA, recognized a threat to our clients’ portfolios and triggered reallocations to remove risk. Each of these occasions proved to be normal (albeit volatile) pullbacks within a cyclical bull market in stocks. During each of these times it could be easily argued that we jumped the gun and should have stayed put. If we had, we would have likely captured all of the gains on the bounce back up. The box on the far right that reflects market conditions over the past two months is especially revealing. The stock market dropped 10% straight down and then rose straight back up four times in a row. This “whipsaw” is certainly not fun and results in questions like, “Why aren’t you keeping up with the S&P 500 this month?” The red circled timeframes reflect real bear market conditions, which we believe can irrevocable damage investors and can cause us to violate our drawdown parameters. This is what we (via CARA) seek to avoid and why our process is so robust. We are always listening for the train, even when we cannot see it. We get off the tracks even if the train may ultimately end up somewhere else, and even if it causes us a delay in getting to our destination. As my mother has said many times, it is better to be a little late and get there alive.

Download a PDF of this commentary at the following link: