Wednesday, the Federal Reserve concluded its July meeting and raised the Fed funds rate by another 25 basis points. We are now sitting at 5.25-5.50%, which is the highest level in 22 years. Chairman Powell left additional hikes on the table during his press conference. The Fed’s actions and rhetoric continue to put pressure on bonds and other fixed income assets. This follows one of the worst years in history for these once viewed as “safe” assets. The major stock indices on the other hand have brushed aside all the potential negatives associated with rates having now jumped 525 basis points in just over a year and have continued to climb out of the bear market hole they found themselves in. The Nasdaq has led the way on the back of the so called “magnificent 7” mega cap technology stocks. These stocks include Apple, Meta, Amazon, Microsoft, Tesla, Google and Nvidia. All these were down 30-50% last year, so a big rally during the first half of the year may have been due.

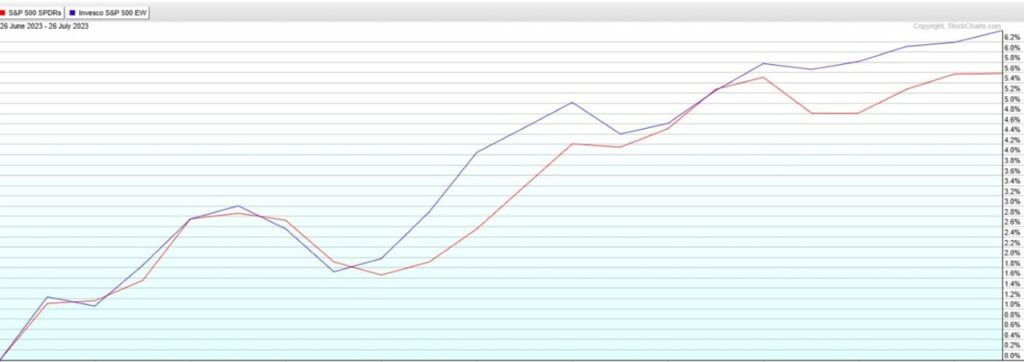

What is better news is that we have begun to see other areas of the “market” catch up. I have mentioned this breadth issue many times and it continues to improve. The most obvious example is that we have seen the Dow Jones Index (DIA) begin to make up lost ground and has been positive 13 straight days as of this writing on July 27. The equal weight S&P 500 has also outperformed the market cap weighted version over the past month (see below chart). This means other parts of the economy are now participating in the rally. The same can be said for small and mid-cap stocks. We also just got a Dow Theory buy signal as evidenced by both the Dow Industrials and Transports breaking out into new uptrends together. This is all good news in my opinion and suggests markets can move higher over the course of the next six months.

My optimism is supported by continued underlying resilience in the economy all while inflation is trending lower. It is to be expected that the historic rise in interest rates would bring down inflation (after all that is why the Fed is raising them), what is remarkable is that it is occurring without any apparent ill effects on GDP growth, corporate earnings or employment. GDP and employment numbers came in this morning better than forecast again. I think most economists (and investors) out there are dumbfounded and left scratching their heads because history (and the inverted yield curve) would suggest the economy is going to be impacted in a big way by the pressure on demand coincident with tightening credit conditions. History says we would see a jump in unemployment and a recession. So far that just hasn’t happened, and stocks reflect that. I think no one can successfully model or predict the results of the pandemic and the fiscal and monetary policies that accompanied it. We have just never in history seen anything like it.

So, we are left with the technicals. The technicals say we have entered a new bull market as of late spring. The volatility index (VIX) agrees and is now at pre pandemic levels. As such, the market is bullish until proven wrong, despite all the arguments to the contrary.

At Cabana, we are currently in our Transitional Bullish (improving) scene.

Equal v. Market Cap Weighted S&P 500 Performance Over the Past Month

Source: Stockcharts.com